Staff

- Home

- Staff

Our Team

Thomas Jumes, RTRP

Tom founded the firm in 1987 which started as a tax practice. He holds the designation of Registered Tax Return Preparer and has passed the Enrolled Agents exam. Tom manages and operates the business interfacing with clients both with tax preparation and planning. He primarily works with clients identifying their planning needs ranging from tax and retirement to insurance and investment planning services.

AREAS OF PRACTICE

- Individual and small business taxation and planning

- Retirement planning

- Insurance analysis and advising

- Investment planning

EDUCATION AND EXPERIENCE

- Graduate, Management: Elmhurst College

- Enrolled Agent

- Registered Tax Return Preparer

- Registered Investment Advisory

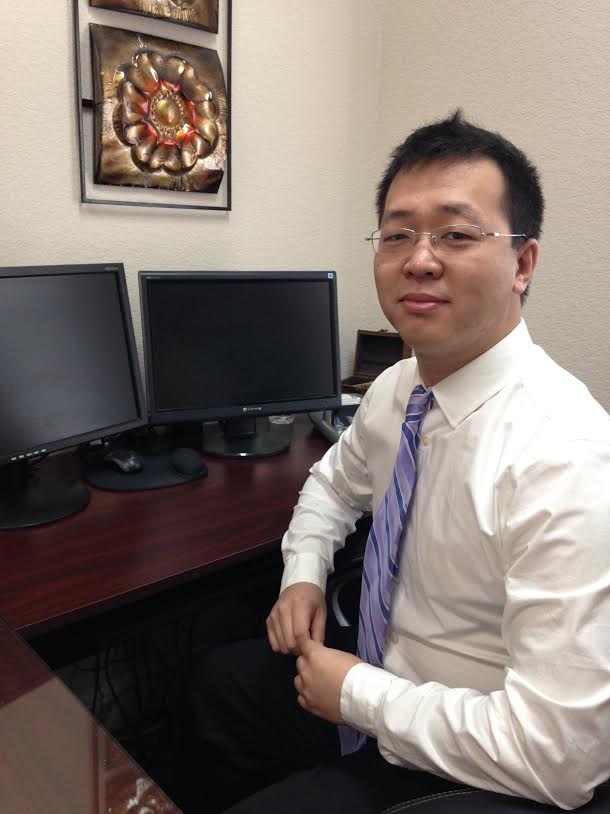

"Max" Zhen Lin, CPA

Max joined the firm in Fall 2014 as a tax accountant. Originally from Nanning, China, Max graduated in August 2014 from Missouri State University with a Masters in Accountancy. Max has also passed the CPA exam and is license in Colorado. Prior to joining the firm, he worked with Volunteer Income Tax Association preparing individual tax returns. Max is experienced in individual, partnership, corporate, trust, and estate taxation and is responsible for research and preparation supervision in the office.

AREAS OF PRACTICE

- Individual, business, and estate taxation

- Tax planning

- Small business consulting

- Accounting system setup and review

- IRS representation

EDUCATION AND EXPERIENCE

- CPA, Texas State Board of Accountancy

- CPA, State of Colorado

- Grauduate, Masters in Accountancy, Missouri State University

- Fluent in Mandarin and Cantonese

Tonya Cossman, RTRP

Tonya is the firm’s Bookkeeping and Payroll Supervisor. She joined the firm in January 2011 as a tax preparer and moved into the bookkeeping area shortly thereafter. Prior to joining the firm, Tonya had worked with H&R Block for four years preparing individual and small business returns. Tonya serves dual roles, she prepares partnership and corporate taxes and trains and manages the bookkeepers and accountant as well. She regularly consults with clients regarding their accounting systems setup and management. And Tonya oversees the sales and payroll tax reporting and remittance.

AREAS OF PRACTICE

- Individual and business taxation

- QuickBooks setup and consulting

- Bookkeeping and payroll reporting

- Sales tax reporting

- Payroll tax reporting

EDUCATION AND EXPERIENCE

- Graduate, Alvin High School, Alvin, Texas

- Registered Tax Return Preparer

Kathleen Cavanna, RTRP

Kathleen has been with the firm since 1994. She graduated Magna Cum Laude from the University of Houston with a bachelors in Accounting. Kathleen has over 35 years of experience in individual, business, and trust and estate taxation. Kathleen has prior experience working for Volunteer Income Tax Association and another CPA in Houston prior to joining the firm. Kathleen is responsible for leading the team in tax research and resolution and specialized in individual and business tax planning and preparation.

AREAS OF PRACTICE

- Individual, business, and estate taxation

- Tax planning

- Tax research

EDUCATION AND EXPERIENCE

- Graduate, Magna Cum Laude, Bachelors in Accounting, University of Houston

- Registered Tax Return Preparer

Marianela Padilla, RTRP

Maria has been with the firm since 1993. She grew up in Fort Worth and is a 1984 graduate of Diamond Hill. She specializes in individual and small business tax preparation and accounting services. Maria works with clients heading up the payroll reports and W-2 filings for our small business clients and supervises and instructs the office staff in documentation of client records.

AREAS OF PRACTICE

- Individual, business, and estate taxation

- Individual taxation

- Bookkeeping and payroll reporting

- Payroll tax reporting

EDUCATION AND EXPERIENCE

- Graduate, Diamond Hill Jarvis High School, Fort Worth, Texas

- Registered Tax Return Preparer

- Fluent in Spanish

Naomi Chen

Naomi joined the firm in December 2014 as a tax accountant. Originally from Dhaling, China, Naomi has a dual bachelors in Accounting and Human Resources. She also graduated from Missouri State University with a Masters in Accountancy. Prior to joining the firm, Naomi worked with the Volunteer Income Tax Association preparing individual tax returns. She is knowledgeable about individual and business taxation. Naomi also helps with clients who have complicated sets of books and accounting systems.

AREAS OF PRACTICE

- Individual and business taxation

- Tax planning

- QuickBooks setup and consulting

- Bookkeeping and payroll reporting

EDUCATION AND EXPERIENCE

- Graduate, Masters in Accountancy, Missouri State University

- Fluent in Mandarin

Leo Liu

Leo has been with the firm since January 2015 and is a financial accountant. Originally form Beijing, China, Leo has a Masters in Business Administration from Missouri State University. Leo has experience with small business accounting and payroll when he worked for a CPA in Springfield, Missouri prior to joining our firm. To help understand all aspects of a client’s business concerns, Leo works on small business and corporate tax returns. He works closely with our small business clients to develop business assessments and improved financial tracking systems

AREAS OF PRACTICE

- Business taxation

- Business planning and analysis

- QuickBooks setup and consulting

- Bookkeeping and payroll reporting

- Financial analysis

EDUCATION AND EXPERIENCE

- Graduate, Masters in Business Administration, Missouri State University

- Fluent in Mandarin

Cassandra Brooks

Cassandra joined the firm in May 2014 and works as an Accounting Assistant. She has completed courses in Bookkeeping and currently attends Tarrant County College working towards her Associates Degree in Accounting. Cassandra is responsible for bookkeeping and payroll for our small business clients. She specializes in reporting for the transportation and food services industries

AREAS OF PRACTICE

- Bookkeeping and payroll reporting

- Payroll tax reporting

- QuickBooks setup

- Transaction posting consultation

EDUCATION AND EXPERIENCE

- Graduate, Springtown High School

- Currently attends Tarrant County College, concentration Accounting

Jennifer Murphy

Jennifer joined the firm in November 2015 as a bookkeeper. She has over 20 years experience performing various accounting and payroll functions. She works with our business clients to maintain their books and payroll.

Angela Benjamins

Angela joined the firm in December 2015. She recently relocated to Texas from North Carolina. Angela has an Associates Degree in Business Administration and Accounting and is working towards her bachelors degree in Accounting. Her responsibilities are bookkeeping and payroll for the small business clients.

Karen Jumes

Karen is the office manager and joined the firm in 2003. Karen has many years of experience as an Office Manager/ Pediatric Nurse of a local pediatrician where she handled both patient and staff issues on a regular basis. At our office, she is responsible for contacting clients to obtain answers to issues raised by the staff in preparing their returns and when returns are ready and available for pick up during the tax season.